China's Home Appliance Consumption Trends in 2025 (Part 1): Upgrading to Smart Appliances, Revitalizing the Smart Home

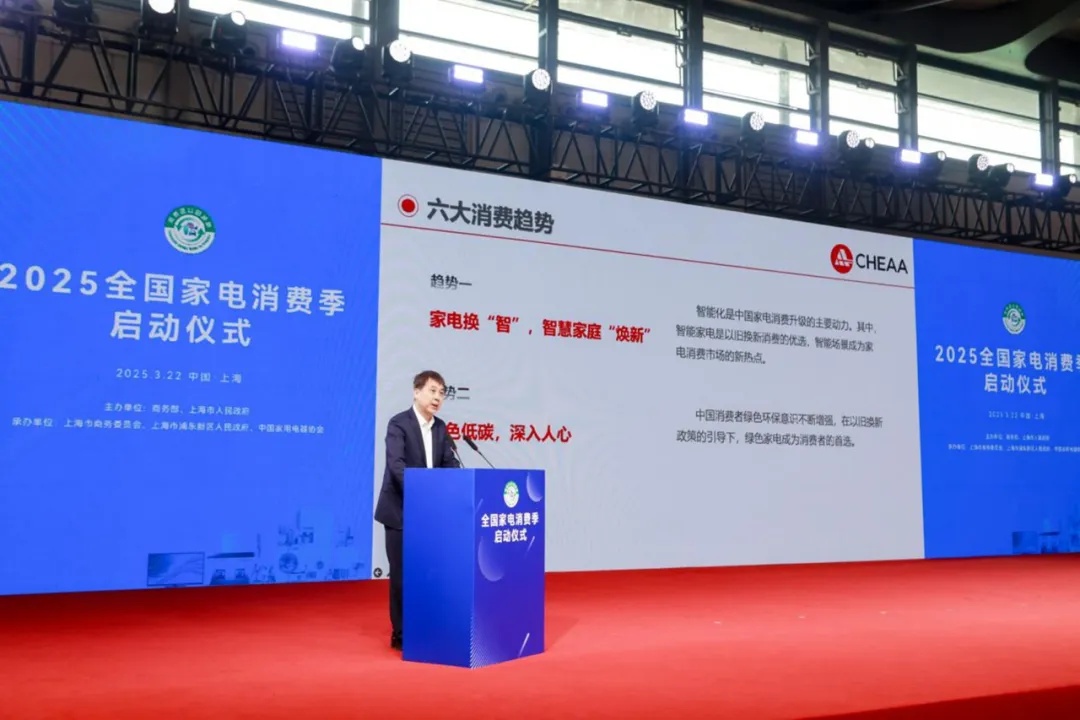

On March 22, the launch ceremony for the "2025 National Home Appliance Consumption Season" was held at AWE2025 at the Shanghai New International Expo Center. At the ceremony, the "2025 China Home Appliance Consumption Trend White Paper" (hereinafter referred to as the “White Paper”) was officially released. Compiled by the China Household Electrical Appliances Association, the White Paper highlights key consumption trends driven by both the trade-in policy and technological innovation.

The White Paper identifies six major trends in China’s home appliance consumption. One of the most prominent among them is: upgrading to smarter appliances to refresh smart homes.

At the release of the White Paper, Xu Dongsheng, Vice President of the China Household Electrical Appliances Association, emphasized that intelligentization is the main direction for the upgrading of home appliance consumption in China. The implementation of the trade-in policy for consumer goods has accelerated the intelligent upgrade of home appliances. On one hand, upgrading to smart appliances has become the mainstream trend, with consumers prioritizing smart products when replacing old ones. On the other hand, smart living scenarios have become a new hot topic in the market, fueling the development of the home appliance replacement market.

Smart Appliance Upgrades

Upgrading to smart appliances has become a major consumer trend in China’s current home appliance market. After more than a decade of development, the smart appliance market continues to grow, with increasing levels of intelligence across major product categories. The market share of smart products within various home appliance categories has been rising steadily year by year. According to data, in 2024, smart products accounted for over 50% of retail volume in the markets for televisions, air conditioners, refrigerators, washing machines, range hoods, gas stoves, and dishwashers. The smart penetration rate for products such as TVs, air conditioners, and air purifiers has already exceeded 75%.

The recently concluded AWE2025 clearly showed that the supply of smart home appliances is increasingly abundant. AI has become the main driver behind the development of smart appliances and the enhancement of intelligent user experiences. A wide range of AI-enabled smart appliances will enter the Chinese market this year, offering consumers more choices for replacing their old devices. For instance, the Haier AI Full-Space Freshness Refrigerator, integrated with the DeepSeek large model, can detect over 1,300 types of food odors using its smell sensors, and generate personalized recipes dynamically based on the user’s health data.

It’s also worth noting that the integration of robotics and home appliances is rapidly entering Chinese households. On one hand, the use of robotics technology in appliances is bringing structural transformations to traditional products. Take the Roborock G30 Space as an example. With a bionic robotic arm, it can flexibly grasp objects, clean collaboratively, and perform multiple advanced functions. On the other hand, service robots are entering homes. Powered by AI, these robots can not only perform household tasks like cleaning and carrying items but also engage in natural conversations, understand user emotions, and become intelligent companions in the smart home.

The White Paper notes that intelligent features are becoming a key factor influencing consumer decisions. Consumer recognition of smart home appliances continues to rise, with more people willing to pay for smart products. For example, stove-and-hood sets with linked smoke-extraction functionality have gained popularity and become bestsellers in online markets, growing at a much faster pace than the overall market.

By 2025, as product replacement becomes the dominant market trend, smart appliances will continue to unleash strong market potential, becoming the top choice for consumers looking to upgrade.

Smart Scenario Upgrades

Under the guidance of the trade-in policy, smart home scenario upgrades are also emerging as a hot topic in China’s consumer market.

Smart scenarios have now taken over from smart standalone products as the preferred option for consumers upgrading their homes. Building on intelligent product applications, smart homes are actively expanding into lifestyle areas such as clothing, food, housing, learning, entertainment, health, and elderly care, offering smart experiences and value-added services. Smart security systems, intelligent kitchens, sleep solutions, and health-oriented bathrooms are increasingly maturing and becoming widespread.

Consumer awareness of smart homes is also evolving—from a basic combination of smart devices to more complex, interconnected smart living scenarios. Smart scenario consumption has become a growing trend. At AWE2025, more mature smart scenarios have begun to enter everyday life. With a wider variety of smart scenarios, various smart devices now collaborate to create various scenarios for healthy eating, comfortable sleep, fitness, wellness, and more—empowering consumers to build a better intelligent lifestyle.

At the same time, changes in appliance distribution channels are driving upgrades in smart home consumption. More and more companies are now bundling smart products into smart scenarios, offering one-stop smart home solutions. For example, companies like Sanyiniao and Huawei provide customized scenario-based services, delivering fully integrated smart home solutions tailored to different user needs.